Bitcoin a cryptocurrency that has shown rapid fluctuations during the last few months. That creates a fear in the investors' minds that bitcoin is likely to crash at some point. As an option for this risk, they tend to short.

Now, what is Short-selling, or Shorting? It is an investment method that allows you to benefit from drops of prices of an asset like bitcoin. Shorting is available for various markets as well as various cryptocurrencies. In this article, 7 ways to short bitcoin for future safety are provided.

How do Shorting works?

[g_article_ads]

Bitcoin shorting is very easy to understand. Just like in other markets like the stock market, bitcoin shorting is also done through the same scenario.

- First, you borrow a certain amount of bitcoin.

- As soon as you receive them, you sell them to the current market price.

- Wait until the price drops and buy that amount of bitcoin.

- Then again you can return them to the lender.

This is simply a summary of shorting. Since the price is less expensive than when you borrow it, you can refund your loan and keep your total payback and trading differences.

Ways to Short Bitcoin

To be able to make a short order for Bitcoins, you must contact a trading company or a platform. The agency will then sell Bitcoins from its supply, assuming you pay them with a similar number of Bitcoins in the future.

1. Future contract / Market

In future transactions, a buyer agrees to buy the security with a contract specifying when the security is being sold and at what price. You will likely feel that the price of the security will be increased if you purchase a futures contract, which will ensure that you will get a lot of safety afterward. However, it suggests a bizarre attitude and a prediction that Bitcoin will fall in prices if you sell a futures contract.

Bitcoin can be purchased or traded using exchangers or, brokerages which will be discussed later on.

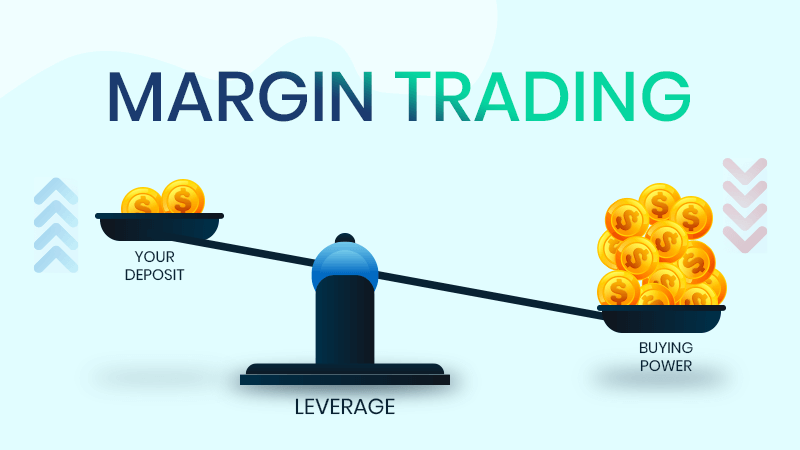

2. Direct margin trading

If your broker allows margin trading, Bitcoin can be shortened directly. Margin trading enables you to buy Bitcoin from your broker to sell and hopefully repurchase it at a lower price, which pockets the difference immediately.

[g_article_ads]

A cryptocurrency trading platform is one of the easiest ways to short bitcoin. Many exchanges and brokerages permit this type of trading, whereby margin trades enable investors to borrow money from a broker to trading. It is important to remember that a leverage factor can increase either your profit or losses.

3. The bitcoin investment trust

The Grayscale Investment Company released a product known as the GBTC, a company that trades over the OTC billboard. It is U.S. investors' only non-future product designed to track bitcoin prices directly. For this purpose, European investors have access to several exchange-traded funds (ETFs). Several ETFs are in the process of being issued in the US pending regulation authorization as it was reported.

4. Blockchain-related stocks

Short blockchain inventories are an excellent way to reduce the entire crypto-currency craze, not just short bitcoin. Some of such stocks are listed below.

- Riot blockchain

- Long blockchain

- Longfin

Like all of the other methods, this is also risky. so you better use only the money you can lose in Bitcoin and the other cryptocurrencies when you trade anything.

5. Binary option trading

You would aim to sell the currency in binary options at the current price, even if the price falls later. Different offshore exchanges offer bilateral options, but costs and risks are high.

NADEX or the North American Derivatives Exchange is a US-based exchange that offers binary options and spreads. What everyone likes most about Nadex bitcoin spreads is the pre-defined risk and reward before trading. In other words, before you enter the trade, you know exactly how much you may lose or earn.

6. Prediction markets

[g_article_ads]

These markets make it possible for investors to create an event based on the results. Therefore, you could say that bitcoin would decrease by a certain percentage or margin, and if someone takes you on this bet, you would profit.

7. Short selling bitcoin assets

Sell off tokens at an affordable price, wait until the prices drop, and buy tokens again. Naturally, you can either lose cash or lose bitcoin assets if the price doesn't adjust as you expect.

Short sell CFDs

Contract for Differences means that you agree to simply pay the difference, rather than borrow the Bitcoins, then buy them back at a lower price. So for CFDs, when the price drops without having to face all the troubles of purchasing and selling the coins, you will be paid the difference.

Several platforms that help with CFD. eToro and TD Ameritrade are two of them. You can open a trade on the BTC/USD instrument when you open and verify your account. Select "sell" rather than "buy."

Bitcoin Exchange

Bitcoin exchangers offer short-selling as well as leveraged shorting. To buy the Bitcoins you want to shorten, you can borrow more money on the exchange than you own there for real. Leveraging is considered to be very risky because if you don't do things as desired, the trade closes your business as soon as you expect, as they know you don't own the money you use.

The exchanges that help to short-sell include, BitMEX, Bitfinex, and Kraken.

Shorting Risks

Short sales are a high-risk task for any asset. In general, your losses are limited to the amount of money you invested in this asset if you invest in the asset. However, your losses could go much further than your initial investment when you sell short.

[g_article_ads]

As short-selling is very risky you should invest your asset only if you are confident that the price will drop. Let's say that you borrowed bitcoin now and in the next few weeks the price goes up. You have to return the asset you borrowed at this moment. This means that you have to pay more than you invested to buy that amount of asset. Now you know how much risk is this short-selling.

Analyzing the market for short sell opportunities is very important before doing short selling at once. First, be aware of the past events that caused fluctuation in price, and then be aware of the other factors that impact the price. Some of those impacts are listed below.

- Failures of major exchanges.

- Hostile regulatory and well-known developers' actions.

- Hostiles' actions against bitcoin by the government.

- Bitcoin code discovery exploits wallet security or network operating threats.

- Failure of darknet market

- Hostile advisories from journalists, economists, politicians, bankers, etc.

Author of Get Basic Idea – The Knowledge Base / Bachelor of Technology – BTech, Mechatronics, Robotics, and Automation Engineering.